The BSV Story

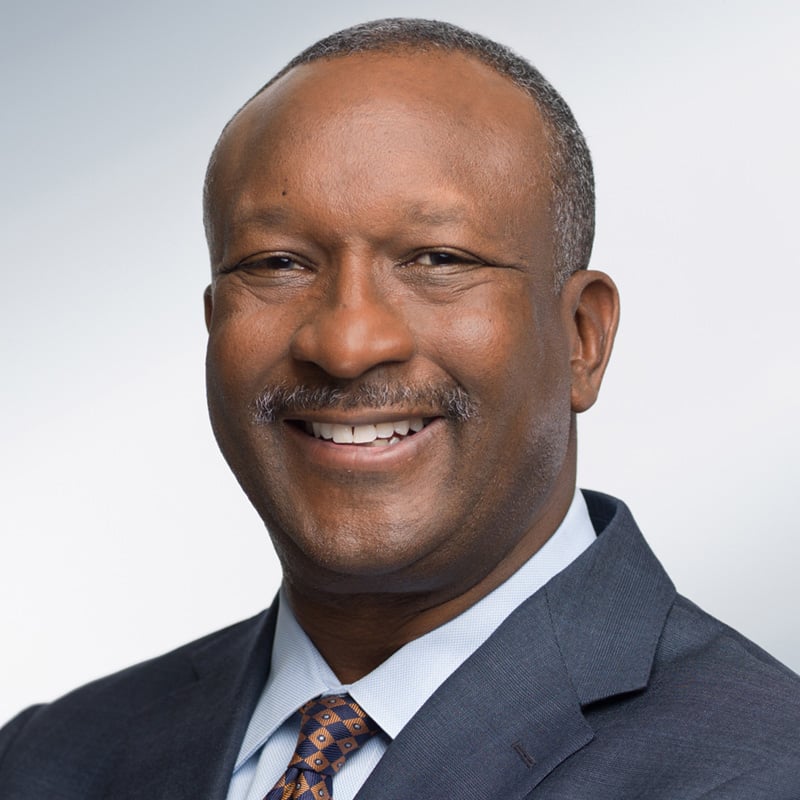

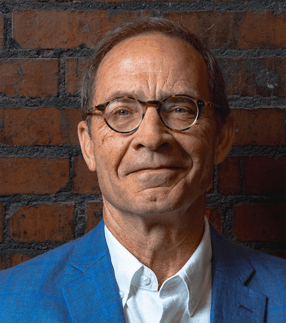

The story of the Boyd Street Ventures starts in 2016, when James Spann and Jeff Moore met at a University of Oklahoma event. James, a Marine veteran and OU alum who was winding down a highly successful 30-year executive career in major life sciences corporations, had served for several years on numerous OU boards and committees. Jeff was a veteran of the U.S. Navy, McKinsey & Company, and several entrepreneurial firms and agencies, and had been the Executive Director of the Ronnie K. Irani Center for the Creation of Economic Wealth (I-CCEW) since 2010. James and Jeff had both spent the past several years witnessing the same problem: Too many promising startups from Oklahoma and other Heartland states had great ideas and supporting research but were unable to raise the funding necessary to launch and scale their innovations.

The underlying cause of the problem was obvious: Oklahoma- and other Heartland-based startups weren’t getting the attention of the country’s leading venture capital firms based on the East and West Coasts, and the local VCs were few in number and small in stature. James and Jeff saw only one viable solution: to found a VC firm that would be based in Oklahoma – OU’s hometown of Norman, to be specific – and focus primarily on Oklahoma- and other Heartland-connected startups. In 2021, after five years of extensive study and planning, they opened Boyd Street Ventures. And in 2022, they launched their Fund I and moved into their current headquarters located across Boyd Street from OU in the former home of the legendary Harold’s Clothing store, where James had worked as an OU student.

Early on, James and Jeff landed on a groundbreaking investment thesis:

Focus on Under-the-Radar Startups

Rather than investing in startups whose prices are being bid up by large East and West Coast VCs, BSV focuses its investment strategy on more attractively priced “under-the-radar startups” - including ones located in or otherwise connected with the state of Oklahoma.

Pursue Above-the-Crowd Returns by Being Active Investors

Unlike VCs that take a hands-off approach, BSV is an active investor. Its Venture Studio by BSV provides de-risking strategic and operational guidance and other support to help portfolio companies avoid costly mistakes, get to market sooner, scale faster and exit more profitably.

A Passion for Diversity

Another important way we differ from other VCs is our passionate dedication to diversity. In addition to having a Black General Partner, significant percentages of our Management Team, our Strategic and OU Advisory Boards, our Investment Committee members and our portfolio company founders are minorities and/or females.

Embracing diversity isn’t just the right thing to do. It’s also the smart thing to do: McKinsey & Company* studies have repeatedly documented that companies with highly diverse management teams are significantly more profitable than other companies.

Embracing diversification is also the smart thing to do when it comes to managing your portfolio. Investing in a VC fund can be a smart way to diversify. And we believe investing in a fund managed by a groundbreaking VC like Boyd Street Ventures is an especially smart way to diversify.

Since launching Fund I in March 2022, BSV has invested in 16 portfolio companies and made 16 follow-on investments. The firm intends to make more new and follow-on investments in Fund I, which closes on March 31, 2025.

Management Team

Venture Partners & Associates

BSV Fund Advisory Board

Lisa Risser

President & CEO, Jevan Consulting; former SVP Ancillary Operations, Scripps Health

BSV Venture Studio Advisory Board

Jeff Feeney

Advisor, Enterprise Healthcare and Concord Group; Board Advisor, Aeris Surgical Technologies

James Spann

James Spann Jeff Moore

Jeff Moore Kendall Tucker

Kendall Tucker John Pohl

John Pohl Matt Jones

Matt Jones Mia Jackson

Mia Jackson Jeff Spray

Jeff Spray Eliza McCloy

Eliza McCloy

Laura Fleet

Laura Fleet